Introduction

“Arise, awake, and stop not till the goal is reached” said by Swami Vivekanada seems to be the motto of the Indian government which is relentlessly working on bringing India at Global footing as far as the taxation laws are concerned. Along with India many other nations have joined hands to develop and strengthen the anti- tax avoidance measures.

India as a country actively participating in the BEPS G20 Action plan which has issued its final reports in October 2015.It is expected that all the members make relevant changes in their domestic laws in order to align them with the recommendations of this plan.

India, via Fiscal Budget 2017 has inserted a new section 94B, in line with the recommendations of OECD BEPS Action Plan 4, to provide that interest expenses claimed by an entity to its associated enterprises shall be restricted to 30% of its earnings before interest, taxes, depreciation and amortization (EBITDA) or interest paid or payable to associated enterprise, whichever is less.

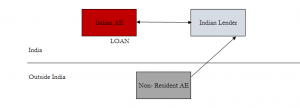

The most common practise of shifting its profit out of India without tax or by suffering lower tax is by charging interest expense to its Associated Enterprise (AE). This results in reduction of profits of AE and the resultant effect is low tax burden on AE due to reduced profits and the interest shifted to the Non-Resident AE in the form of interest may not be taxed or may be taxed at a lower rate. This leads to base erosion in India. To curb such practises BEPS action Plan 4 suggested the countries to introduce provisions limiting the deductions on interest from expenditure. This triggered the introduction of the new section 94B in the Income Tax Act ,1961

Analysis of Section 94B of the Act

| Applicability of provision | Sub-section 1 & 3 |

| Computation of disallowance | Sub-section 2 |

| Carry Forward of disallowed amount | Sub-section 4 |

| Definitions of terms used | Sub-section 5 |

Applicability of provision

Sub-section (1) & (3) of Section 94 B of the Income Tax Act, 1961(hereinafter referred as the Act) lays down that notwithstanding anything contained in this Act, where an Indian company, or a permanent establishment of a foreign company in India, being the borrower, incurs any expenditure by way of interest or of similar nature exceeding one crore rupees which is deductible in computing income chargeable under the head “Profits and gains of business or profession” in respect of any debt issued by a non-resident, being an associated enterprise of such borrower, the interest shall not be deductible in computation of income under the said head to the extent that it arises from excess interest as specified in sub-section (2):

Provided that where the debt is issued by a lender which is not associated but an associated enterprise either provides an implicit or explicit guarantee to such lender or deposits a corresponding and matching amount of funds with the lender, such debt shall be deemed to have been issued by an associated enterprise.

These provisions shall be applicable to an Indian company or a permanent establishment of a foreign company engaged in the business off banking and insurance (sub-section 3).

One can deduce the conditions of applicability from the above provisions. Only on fulfilment of the conditions cumulatively, the restriction on interest shall be applicable

- Interest is payable by an Indian Company or a permanent establishment of a foreign company in India. Banking and insurance company as well as non-corporate assesses are outside the purview of this section.

- Interest is payable to the Non- resident AE or to a third-party lender to whom such Non-resident AE has provided guarantee or deposited matching funds. (this point shall be discussed in detail below)

- The interest received by the non-resident AE or the lender as mentioned above exceeds the threshold limit of INR one crore in the particular financial year.

- Interest is claimed as deductible expenditure against income taxable under the head “Profit & Gains from Business and Profession”.

Section 94B (1) provides that, the debt shall be deemed to be treated as issued by an AE where it provides an implicit or explicit guarantee to the lender or deposits a corresponding and matching amount of funds with the lender.

Borrowing from third party

A Non- resident associated AE can arrange for loans to its Indian AE in two ways

- A guarantee can be given by the Non- resident AE; or

- Matching funds can be provided by the AE to a third-party lender

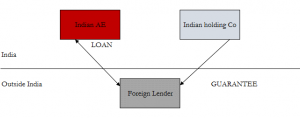

In case of a bank guarantee

When a foreign parent company provides guarantee (implicit or explicit) to an unassociated lender, which further lends fund to Indian AE

[under section 94B(1)] , it shall be deemed to be a transaction with the associated enterprise. The term guarantee has not been described under this section or under the Act therefore once can rely upon the definition given under the Indian Contract Act.

In case of matching funds provided by Non- resident AE

When a non- resident AE deposits funds with a lender which then provides for loan to the subsidiary, such a debt transaction will also be covered within the ambit of Section 94B of the Act.

Q1 Can the transactions in which a mixed guarantee and funds are provided be treated as the transactions covered under section 94B of the act?

For Example, a bank provides a loan to an Indian company based on the guarantee provided by its parent company (Non- resident AE). However, the deposit provided by the Non- resident AE is extends to only 35 percent of the amount. The bank was comfortable that in case of any default by the Indian company, its parent company will make good of the default

Such transactions shall be covered under Section 94B as it talks about an implicit or an explicit guarantee. In the above situation, one can take a view that the parent company is providing a guarantee for the 65 percent of amount of loan. However, the condition that the amount deposited should correspond and match to the debt is not applicable in case of a guarantee.

Q2 How are the transaction of loans treated when the third – party lender is a resident?

For example; –

Interest payments are made by an Indian company to an Indian Bank for debt which is borrowed based on guarantee provided by Non-resident AE.

The provisions of section 94B state that the payments made to a third party shall be deemed to be payments made to an AE and only payments made to non-resident AE’s are covered. Therefore, in this case even if the payments made shall be deemed to be payments made to an AE but the condition of it being a Non- resident AE shall not be fulfilled. In such situation section 94B will not be applicable.

Q3 How are the transactions of loan treated when Guarantee is provided by Resident AE?

For Example; –

When a Foreign bank provides loan to an Indian company and for such a loan guarantee is provided by Indian company’s holding company who in India. Both the AEs are residents of India.

There is no restriction on whether the guarantee is provided by resident AE or a Non- resident AE but the payment of interest made by the Indian company shall be deemed to be a payment to an AE. In this case, payments to Foreign bank shall be deemed to be payments to AE. Here the payment made by the Indian company is to a Non- resident. Therefore, in such situations where a guarantee is given by an Indian company, the transactions attract the provisions of Section 94B of the Act.

II Disallowance and carry forward of interest [Section 94B (2) & (4)]

Section 94B (1) provides that interest shall be disallowed when all the conditions laid thereunder shall be fulfilled whereas 94B (2) deals with the computation of excess interest which is to be disallowed.

Excess interest shall mean; –

- An amount of total interest which exceeds 30% of EBITDA in the previous year; or

- Interest paid or payable to the assessee in the previous year.

—Whichever is lower

This interest can be computed in several ways as suggested by the BEPS report (fixed ratio rule, Group ratio rule, Carry forward rule or the de minimis monetary threshold). India has adopted a fixed ratio rule and therefore a ratio of 30% has been fixed taking into consideration the economic conditions in India.

These provisions shall allow for carry forward of disallowed interest expense to eight assessment years immediately succeeding the assessment year for which the disallowance was first made and deduction against the income computed under the head “Profits and gains of business or profession to the extent of maximum allowable interest expenditure.

III Definitions [Section 94B (5) of the Act]

For the purposes of this section, the expressions—

| Ø “associated enterprise” shall have the meaning assigned to it in sub-section (1) and sub-section (2) of section 92A; |

| Ø “debt” means any loan, financial instrument, finance lease, financial derivative, or any arrangement that gives rise to interest, discounts or other finance charges that are deductible in the computation of income chargeable under the head “Profits and gains of business or profession”; |

| Ø “permanent establishment” includes a fixed place of business through which the business of the enterprise is wholly or partly carried on.’ |

Conclusion

Introduction of section 94B brings about a significant change in the Indian Tax regime. It also portrays India’s active participation in OECD and its will to align the domestic laws with the recommendations of the BEPS report. This amendment will take effect from 1st April, 2018 and will, accordingly, apply in relation to the assessment year 2018-19 and subsequent years. However, the ambiguity in interpretation of this section can lead to increasing litigation in the future unless clarity has been provided by the tax authorities.