Due to increasing cross border transactions, Transfer pricing has become an important international tax issue affecting the MNCs. One of the most essential and contentious facets of transfer pricing provisions is to derive an accurate ALP. Section 92 of Income Tax Act lays down that any income arising from an international transaction or a specified domestic transaction shall be computed having regard to the ALP. The ALP can be computed using any methods laid down under Section 92C read with rules 10B and 10AB. It has been constantly stressed upon by the Tax department that a Most Appropriate Method (MAM) should be used for computing the ALP of any international or specified domestic transaction.

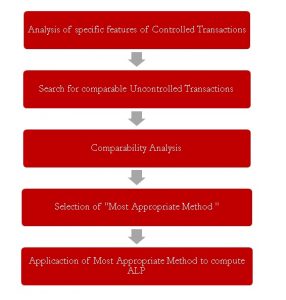

Process of Computation of ALP

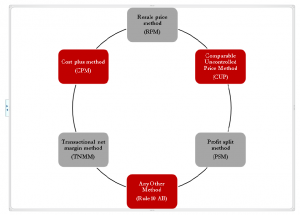

Methods for computing ALP (SECTION 92C READ WITH RULE 10B)

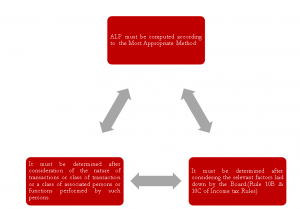

Three Conditions for determination of ALP

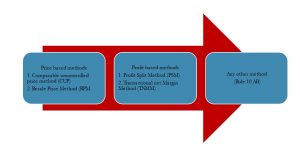

Classification of Methods

Most Appropriate Methods

The income tax authorities have not specified any hierarchy of methods. They insist on using the most appropriate method for computing ALP. The term “Most Appropriate Method” is defined under rule 10F. It entails that the method used must be best suited to the facts and circumstances of transaction, should be the most reliable measure of an arm’s length price and must take into consideration all relevant factors prescribed in Rule 10B and 10C.

Comparable uncontrolled price method (CUP)

It is one of the most comprehensive methods to determine ALP. Under this method, price of a controlled transaction is compared to price of an uncontrolled transaction[1].The price derived is then adjusted for various differences which could materially affect the price in the open market.

Types of CUP

- Internal CUP

Under this method, comparable properties/services from transactions entered into by the assessee with the third parties are considered for benchmarking the price of transactions with associated enterprises. This method can be mostly applied wherein the nature of goods and services transacted between the enterprise and its AE is similar to that transacted with the third party. This method is considered as a litigation proof method to determine ALP.

- External CUP

Under this method, comparable properties/services from transactions entered into by a competitor of the assessee with unrelated parties are considered for benchmarking the price of the transactions of the assessee with associated enterprise. However this method is impractical as in this competitive world rivals do not reveal their confidential information.

Transaction where CUP can be adopted:

- Transfer of goods

- Provision of services

- Intangibles

- Interest on loan

[1] Rule 10AB defines “uncontrolled transaction” means a transaction between enterprises other than associated enterprises, whether resident or non-resident.

Uniliver U.S.A holds 30% of shares in Hindustan Lever, An Indian Company. HUL manufactures compact disc writers and sells them to Unilever and TATAs Ltd.

During the year HUL supplied 10,000 CD writers to Unilever at a price of Rs 2000 per unit.and 100 CD writers to Tatas Ltd at the price of Rs 3000 per unit

The Transactions of HUL with Unilever and TATAs differences comparable subject to following differences

- While sale to Unilever is at FOB, sale to TATAs is at CIF. The freight and insurance paid by Unilever for each unit is Rs 550

- The sale to TATAs is backed by a free warranty for 6 months whereas sale to Unilever are not backed by any such warranty. The estimated cost of executing the warranty may be Rs 250

- Since Unilever places a larger order, HUL offers quantity discount for RS 20 per unit to Unilever.

Computation of ALP

| Particulars | Amount in Rs |

| Sale Price of per unit of CD writer sold to TATA s | 3000 |

| Less: Differences to be adjusted for: | |

| · On account of freight and insurance charges | 550 |

| · On account of cost of warranty | 250 |

| · On account of bulk order | 20 |

| Total | ( 820) |

| Arm’s Length Price of CD writer sold to Unilever |

2180 |

| Prices charged from Unilever (10,000 units x 2000 ) | 2,00,00,000 |

| Arm’s Length Price for 10,000 units (10,000 units x 2180) | 2,18,00,000 |

| Income of Unilever Increased by | 18,00,000 |

Limitations of CUP

- Difficulty in availability of reliable comparable data, especially in case of external comparables.

- Absence of an objective method to monetize differences in contractual obligations.

- Not suited for niche business where the product or service range is unique.

Resale Price Method (RPM)

In this method the purchase price paid to the related entity is compared to the resale price charged to an unrelated party. This method is used when the assessee in question is a distributor who makes purchases from a related party .RPM can be used on aggregate basis where the assessee distributes various products of similar class. Application of RSP is difficult in cases where the reseller adds substantial value to the end product or service.

Non availability of reliable comparable data in case of external comparables is another limitation for application of RPM.

Transactions where RPM can be adopted

- Distribution of goods and services involving no or little value addition

- Resale of packaged services like software licenses etc

- Resale and distribution of tangible goods like cars and other FMCG products

Example:

S co. in India is engaged in the business of selling premium bikes, X. The company imports the bikes from its parent company in London as completely finished and built up unit for sale in India. The company imports the car @Rs 12 lakhs and sells it @Rs 13.5 Lakh in India. M.co India is a dealer for comparable bike Y.M co imports bikes from Portugal @Rs 11.5 and sells at Rs 14 lakhs.

Computation of ALP

| Particulars | Rs in Lakhs |

| Sale Price of Y | 14.00 |

| Purchase Price of Y | 11.50 |

| Gross Profit Margin per car | 2.50 |

|

Gross Profit Margin Ratio = Sale price – Purchase price 100 Sale price |

18% |

| Sale Price of X | 13.50 |

| Gross Profit Margin @ 18% | 2.43 |

| Arm’s Length Purchase Price under RPM | 11.07 |

| Actual Purchase Price of X | 12.00 |

| Transfer Pricing Adjustment Per Car | 0.93 |

Limitations of RSP

- Application of RSP is difficult in cases where the reseller adds substantial value to the end product or service.

- Non availability of reliable comparable data in case of external comparables.

Cost plus method (CPM)

Under this method the costs incurred by the supplier of property or services in a controlled transaction is compared to supplier of service or property in an uncontrolled transaction to determine an appropriate profit mark-up. This mark-up is determined by the reference to the mark-up the same supplier earns in comparable uncontrolled method.

Transactions where CPM can be adopted

- Provision of services

- Joint facility arrangement

- Transfer of semi-finished goods

- Long term buying and selling arrangements.

Example

A ltd Germany holds 35% shares in B ltd India. B ltd develops software and does both onsite and offsite consultancy services for various customers. B ltd during the year billed A ltd Germany for 100 man hours at the rate of Rs 2000 per man hour. The total cost (direct & indirect) for executing this work amounted to Rs 175000

B ltd billed C ltd at the rate of Rs 3000 per man-hour for the similar level of man power and earned a gross profit of 50% on its cost.

The transactions of B.LTD with A Ltd & C. Ltd are comparable subject to the following differences

- B .Ltd derives technological support from A Ltd, There is no such support from C Ltd. The value of technological received from A Ltd may be put at 20% of normal Gross Profits

- Discount given by B Ltd to A Ltd due to business in large volumes. Quantity discount may be valued at 10% of normal gross profits.

- In case of rendering services to A.Ltd, B Ltd neither runs any risk nor incurs any marketing costs. On the other hand, in case of services to C Ltd, B Ltd has to assume all the risks and costs associated with marketing function which may be estimated at 10% of normal gross profits.

- B Ltd offered one month credit to A. Ltd. The cost of providing such credit may be valued at 3% of gross profits. No such credit was given to C Ltd.

| Particulars | |

| Price charged to C ltd | 3000 |

| Gross Profit mark up in case of C Ltd | 50% |

|

LESS : Differences to be adjusted for: ® Technology support from A.Ltd (20% of 50%) ® Quantity Discount to A.Ltd (10% of 50%) ® Risk Factor (10% of 50%) |

10% 05% 05% |

| Total (A) | 30% |

| Add: Cost of Credit to A Ltd (B) | 1.50% |

| Arm’s length Gross Profit Mark Up (A + B) | 31.50% |

| Direct & Indirect Cost | 1,75,000 |

| Arm’s Length Income (1, 75,000* 31.50%) (C) | 2,30,125 |

| Income Actual (100 man hours x 2000) (D) | 2,00,000 |

| Increased Income (C – D) | 30,125 |

Profit split method (PSM)

Owing to the complexity of certain transactions, which involves transfer of unique intangibles or consisting of multiple transactions which are so interrelated that they cannot be evaluated separately for the purpose of determining the arm’s length price of any one transaction, profit split method is applied.

Transactions where PSM can be adopted

- Integrated services provided by more than one enterprise

- Transfer of unique intangibles

Example

ZMC technology Singapore holds 27 % shares in Amco Ltd India. Further, Crest Ltd U.S.A holds 32% shares in Amco Ltd India. Amco ltd India develops software and does both onsite and offsite consultancy. Crest Ltd U.S.A has a worldwide presence.

Crest ltd U.S.A received an order from Tirum Ltd U.S.A for developing a software product. In order to execute the same, ZMC Technology Singapore, Crest ltd U.S.A & Amco Ltd India has contributed integrally to the development of the software product. Crest Ltd U.S.A finally delivers the product to Tirum Ltd and receives consideration of $50,000.

Crest Ltd USA in turn pays to ZMC technology Singapore and Amco Ltd India a sum of $10000 and12000 respectively to keeps the balance to itself

In the entire transaction a profit of $1000 is earned. Amco ltd India incurred total cost of $9500 in executing its functions relating to above project.

On the basis of functions performed, risks assumed and assets employed, the relative contribution may be taken at 50%, 20 %, 30% for Amco ltd India, ZMC Technology Singapore, Crest Ltd USA respectively.

The ALP shall be determined as under

| Particulars | Amount in USD |

| Price charged by Crest ltd to Tirum ltd | $50000 |

| Amco ltd India’s share of revenue | $12000 |

| ZMC ltd Technology Singapore’s share of revenue | $10000 |

| Crest Ltd USA’s share of revenue | $28000 |

| Combined total profits | $10000 |

| Evaluation of relative contribution: | |

| Amco ltd 50% | $5000 |

| ZMC ltd Technology Singapore 20% | $2000 |

| Crest Ltd USA 30% | $3000 |

| Total cost of Amco Ltd India | $9500 |

| Income of Amco Ltd India on Arm’s length price | $14500 |

| Actual revenue of Amco Ltd | $12000 |

| Increased income | $2500 |

Transactional Net Margin Method (TNMM)

This is one of the most widely used methods. Under this method a ratio of net profit margin is derived by using an appropriate base such as sales costs assets that an assessee realises from a controlled transaction. This is compared to the net profit ratio similarly derived in case of a comparable uncontrolled transaction. External as well as internal comparables can be used for comparison. However, this method is used in cases where the activities are not complicated, the products and services are standardized and comparable. Relevant and reliable data is required to compute ALP under TNMM method.

Transactions under which TNMM method can be adopted

- Provision of services

- Distribution of finished products where resale price method cannot be applied

- Transfer of semi- finished goods cost plus method cannot applied

- Transactions involving intangibles where profit split method cannot be applied

Example

HUL exports shampoos to UL United Kingdom, an associated enterprise and earns a net profit of 10% on sales. The sales are Rs 10,000 crores and net profit is Rs 1000 crores.

Procter and Gamble India also exports shampoos to other countries and earning a net profit of 25% on its sales. Procter and Gamble’s net profit is higher by 2% since its sales are to European Countries only where 2% higher margin on sales exists.

Adjusted net profit (25%-2%) 23% on basis of TNMM .When applied to sales of HUL, 23% of 10,000 crores comes to 2300 crores.

Hence an addition of Rs 1300 crores shall be made to income of HUL.

Any other method (Rule 10 AB)

The introduction of the sixth method widens the horizons for the Assesses wherein they can compute the ALP using any other method which takes into consideration:

- Price which has been charged or paid; or

- Would have been charged or paid for the same or similar uncontrolled transactions

With or between non-associated enterprises, under similar circumstances considering all the relevant facts.

Process for calculation of ALP as per OECD guidelines

The process of determination suggested by OECD Guidelines is an accepted Good Practice, However, it is not a mandatory to follow these guidelines. OECD stresses upon the principle “Reliability of outcome is more important than the process”. The steps to compute ALP as per OECD Guidelines are given below;

Step 1: Determination of Years to be covered

Step 2: Broad-Based Analysis of Tax-payer’s circumstances

Step 3: Understanding the controlled transactions under examination, based on functional analysis, in order to choose:

- The tested party

- The Most Appropriate Method

- To identify the significant comparability factors

Step 4: Review of existing internal comparables, if any

Step 5: Determination of available sources of information on external comparables

Step 6: Selection of Most Appropriate Transfer Pricing Method

Step 7: Identification of potential comparables

Step 8: Determination of and making comparability adjustments where appropriate

Step 9: Interpretation and use of data collected, determination of the Arm’s Length Remuneration.