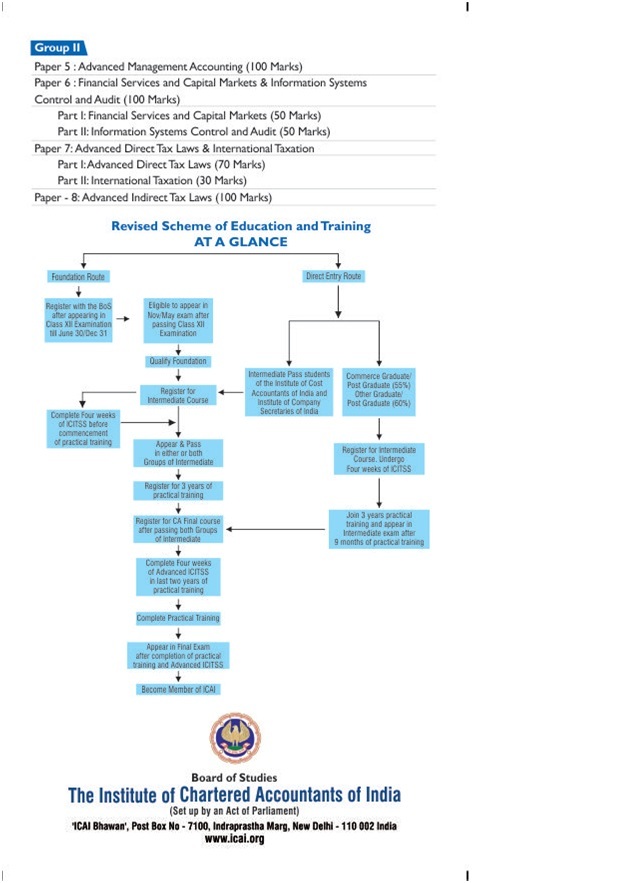

Revised Scheme of Education and Training for chartered Accountancy Course

Revised Scheme: Route I – Foundation Course#

Under the Foundation Course Route, he following steps are required:

- Register with Board of Studies(BoS) after appearing in Class XII examination till June 30/Dec 31.

- Be eligible to appear for Foundation examination after passing Class XII examination. The first Foundation examination can be taken in November/May, as applicable, following passing of Class XII examination.

- Qualify Foundation Course.

- Register with the BoS for Intermediate Course.

- Complete 8 months of study course.

- Appear and Pass in either or both Groups of Intermediate Course.

Successfully complete Four Weeks Integrated Course on Information Technology and Soft Skills(ICITSS) before commencement of the Practical Training.

- Register for Three years Practical Training on passing either or both the Groups of Intermediate Course.

- Register for the Final Course after qualifying both the Groups of Intermediate Course.

- Successfully complete For Weeks Advanced ICITSS during the last two years of Practical Training.

- Complete Practical Training.

- Appear in Final examination after completion of Practical Training and Advanced ICITSS.

- Become Member.

#Note: ICAI has decided in principle the above mentioned Scheme. However, the scheme will be notified in the official Gazette in due course.

Revised Scheme:Route II- Direct Entry Route#

The ICAI allows Commerce Graduates/Post-Graduates(with minimum 55% marks) or Other Graduates/Post-Graduates (with minimum 60 % marks) and Intermediate level passed students of Institute of Company Secretaries of India and Institute of Cost Accountants of India to enter directly to its Intermediate Course. The following steps are required to be undertaken by the eligible Graduates under this route:

- Register with the BOS for the Intermediate course (provisional registration allowed to the students doing Final year of graduation).

- Successfully complete Four Weeks Integrated Course Information Technology and Soft Skills(ICITSS) before commencement of the Practical Training.

- Register for Three Years Practical Training.

- Appear in Intermediate Examination after Nine months of Practical Training.

- Qualify Intermediate Course.

- Register for the Final Course after qualifying both Groups of Intermediate Course.

- Successfully complete Four Weeks Advanced ICITSS during the last two years of Practical Training.

- Complete Practical Training.

- Appear in Final examination after completion of Practical Training and Advanced ICITSS.

- Become Member

Note: Candidates who have passed Intermediate level examination of ICSI or ICWAI and enter the CA Intermediate course directly shall be treated at par with Foundation passed students and shall have to undergo the CA course in the manner skin to the Foundation passed students.

Foundation Course

Number and Name of Papers

Number of Papers-4

Paper I: Principles and Practices of Accounting(100 Marks)

Paper 2: Mercantile Law & General English(100 Marks)

Part I: Mercantile Law(60 Marks)

Part II: General English(40 Marks)

Paper 3*: Business Mathematics and Logical Reasoning & Statistics(100 Marks)

Part I: Business Mathematics and Logical Reasoning(60 Marks)

Part II:Statistics (40 Marks)

Paper 4*: Business Economics & Business and Commercial Knowledge(100 Marks)

Part I: Business Economics (60 Marks)

Part II: Business and Commercial Knowledge (40 Marks)

*Paper 3 and Paper 4 will be Objective type papers.

Note

- Passing percentage:Aggregate-50% and Subject-wise-40% at one sitting.

- Objective type question of I or more marks.

- Examination: In the months of November and May after passing Class XII.

Intermediate Course

Number and Name of Papers

Number of Papers-8

Group I

Paper I:Accounting (100 Marks)

Paper 2: Corporate Laws & Other Laws(100 Marks)

Part I: Corporate Laws(60 Marks)

Part II: Other Laws(40 Marks)

Paper 3: Cost Accounting(100 Marks)

Paper 4: Direct Tax Laws & Indirect Tax Laws(100 Marks)

Part I: Direct Tax Laws(60 Marks)

Part II:Indirect Tax laws(40 Marks)

Group II

Paper 5:Advanced Accounting(100 Marks)

Paper 6:Auditing and Assurance(100 Marks)

Paper 7:Financial Management & Business Economic Environment(100 Marks)

Part I:Financial Management(60 Marks)

Part II:Business Economic Environment(40 Marks)

Paper 8:Information Technology & Strategic Management(100 Marks)

Part I: Information Technology(60 Marks)

Part II: Strategic Management(40 Marks)

Four Weeks Integrated Course on Information Technology and Soft Skills

- Duration: 4 weeks (2 weeks for soft skills and 2 weeks for IT)

- When to complete: Students registering for the Intermediate Course shall be required to successfully complete ICITSS before commencement of Practical Training.

Practical Training

- Duration of Practical Training: Three Years

- Commences after completing Integrated Course on Information Technology and Soft Skills(ICITSS) and passing either or both Groups of Intermediate Examination.

- For direct entrants coming through Graduation and Post Graduation route, the Practical Training commences immediately after they complete four weeks ICITSS.

Advance Four Weeks Integrated Course on Information Technology and Soft Skills(AICITSS)

Duration: 4 weeks(2 weeks for soft skills and 2 weeks for Advance IT)

When to complete: Students undergoing Practical Training shall be required to do AICITSS during the last 2 years of Practical Training but to complete the same before appearing in the Final Examination.

Final Course

Number and Name of Papers

Number of Papers-8

Group I

Paper 1: Financial Reporting(100 Marks)

Paper 2: Strategic Financial Management(100 Marks)

Paper 3: Advanced Auditing and Professional Ethics(100 Marks)

Paper 4:Corporate Laws and Other Economic Laws(100 Marks)